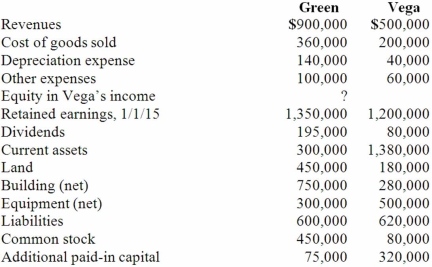

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2015. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2015, consolidated revenues.

Definitions:

Q3: How is goodwill amortized?<br>A) It is not

Q5: Southern blot is used to detect which

Q17: Fine Co. issued its common stock in

Q39: The financial balances for the Atwood Company

Q40: Thomas Inc. had the following stockholders' equity

Q78: Pot Co. holds 90% of the common

Q106: On January 4, 2012, Harley, Inc. acquired

Q114: Kaye Company acquired 100% of Fiore Company

Q114: Fargus Corporation owned 51% of the voting

Q119: X-Beams Inc. owned 70% of the voting