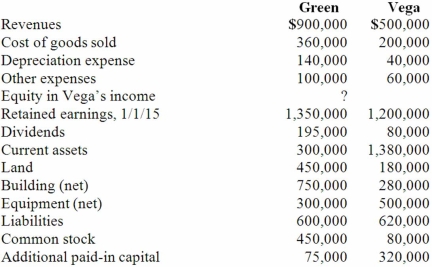

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2015. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2015, consolidated equipment.

Definitions:

IT Architecture

The design and organization of computer systems, including hardware, software, data, and networking components, in order to meet the goals and requirements of a business.

Fixed Costs

Expenses that do not change in proportion to the activity of a business, such as rent, salaries, and insurance payments.

Variable Costs

Costs that vary directly with the level of production or sales volume, such as raw materials and direct labor costs.

CIO's Salary

The compensation package awarded to a Chief Information Officer, reflecting responsibilities in overseeing an organization's technology strategy.

Q4: Dideoxycytidine is added to one of four

Q7: Which of the following molecular-based methods can

Q10: In PCR-SSOP methods for HLA typing, the

Q11: Perry Company acquires 100% of the stock

Q17: All of the following statements regarding the

Q18: Panton, Inc. acquired 18,000 shares of Glotfelty

Q27: Gentry Inc. acquired 100% of Gaspard Farms

Q44: On January 1, 2012, Mace Co. acquired

Q105: What advantages might push-down accounting offer for

Q115: Pell Company acquires 80% of Demers Company