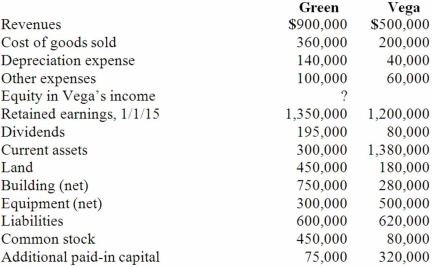

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2015. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2015, consolidated trademark.

Definitions:

Merchandise Purchases Budget

A financial plan detailing the amount of goods a company needs to purchase during a period to meet expected sales demands and maintain inventory levels.

Master Budget

An aggregated budget that represents a company's overall plan of action for a specified period, integrating individual budgets for income, spending, and capital expenditures.

Master Budget

A comprehensive financial planning document that consolidates all of an organization's individual budgets.

Sales Budget

A financial plan detail outlining projected sales for a specific period, guiding marketing and production strategies.

Q2: When a typing method is repeated and

Q17: Fine Co. issued its common stock in

Q37: Stark Company, a 90% owned subsidiary of

Q62: On January 1, 2013, the Moody Company

Q65: On 4/1/11, Sey Mold Corporation acquired 100%

Q67: Pot Co. holds 90% of the common

Q105: Presented below are the financial balances for

Q112: On 4/1/11, Sey Mold Corporation acquired 100%

Q115: On January 1, 2013, Pacer Company paid

Q119: On January 4, 2013, Watts Co. purchased