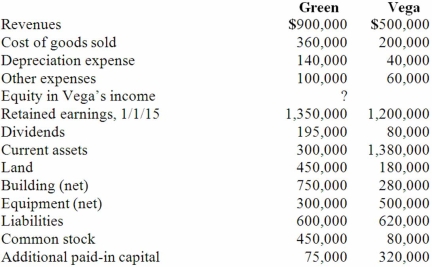

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2015. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2015, consolidated common stock.

Definitions:

Conversion Costs

The combined costs of direct labor and manufacturing overheads incurred to convert raw materials into finished products.

Mixer Base Paint

A customizable foundation paint product to which pigments and other components are added to achieve the desired color and properties.

Factory Overhead

Factory overhead includes all the indirect costs associated with manufacturing, such as utilities, maintenance, and salaries of employees not directly involved in production.

Standard Cost

A predetermined cost of manufacturing, selling, or any other enterprise activity, which serves as a benchmark for assessing performance.

Q5: In HLA nomenclature, the letter N indicates

Q18: When two sequences are found to be

Q24: When a parent uses the initial value

Q31: Acker Inc. bought 40% of Howell Co.

Q32: An intra-entity sale took place whereby the

Q110: Parrett Corp. acquired one hundred percent of

Q113: McGuire Company acquired 90 percent of Hogan

Q115: On January 1, 2013, Nichols Company acquired

Q115: Watkins, Inc. acquires all of the outstanding

Q116: Carnes Co. decided to use the partial