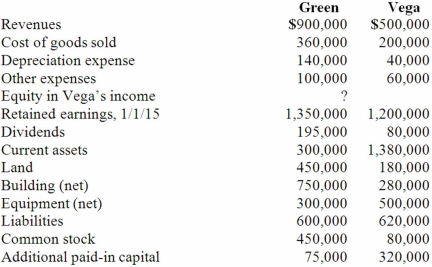

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2015. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2015, consolidated additional paid-in capital.

Definitions:

Top Leadership Positions

These refer to the highest roles within an organization, often responsible for strategic decision-making and organizational direction.

Business World

Refers to the environment of commerce and industry where activities related to the production, distribution, and sale of goods and services occur.

Family-Oriented

Emphasizing the importance of family values and connections, often prioritizing family needs and relationships.

Progressive Organizations

Companies or entities that actively seek to foster innovation, equality, and inclusivity, often emphasizing social responsibility and sustainable practices.

Q11: How are Y alleles inherited?<br>A) As recombined

Q20: A patient with abnormally high iron levels

Q23: Thomas Inc. had the following stockholders' equity

Q35: An intra-entity sale took place whereby the

Q57: Pell Company acquires 80% of Demers Company

Q60: What term is used to describe a

Q62: On January 1, 2013, the Moody Company

Q85: Club Co. appropriately uses the equity method

Q106: For acquisition accounting, why are assets and

Q110: Walsh Company sells inventory to its subsidiary,