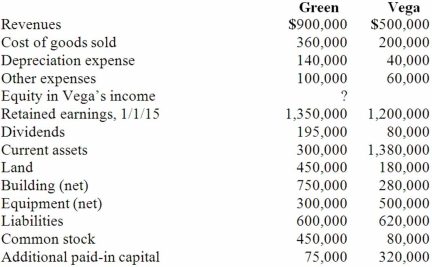

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2015. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2015 consolidated retained earnings.

Definitions:

Magnet Status Hospitals

Hospitals recognized for nursing excellence and high-quality patient care by the American Nurses Credentialing Center's Magnet Recognition Program.

Adverse Events

Unintended and harmful events or reactions caused by medical management or health interventions, rather than by the underlying condition of the patient.

Patient Education

Teaching patients about their health conditions, treatment options, and lifestyle adjustments to promote optimal disease management and prevention.

Care Coordination

The deliberate organization of patient care activities between two or more participants involved in a patient's care to facilitate the appropriate delivery of health care services.

Q5: In measuring non-controlling interest at the date

Q9: In Maxam-Gilbert sequencing, a band that is

Q13: Which of the following is the most

Q15: Pell Company acquires 80% of Demers Company

Q16: The following methods that are used to

Q27: This test is used to determine if

Q28: Stiller Company, an 80% owned subsidiary of

Q91: What ownership pattern is referred to as

Q99: Dalton Corp. owned 70% of the outstanding

Q102: Lisa Co. paid cash for all of