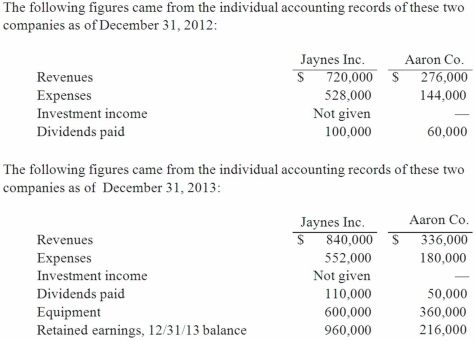

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2012, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2012, when the equity method was applied for this acquisition?

Definitions:

Independent CPA

A Certified Public Accountant who performs an audit without having any conflicts of interest, ensuring impartiality and objectivity.

Acid-test Ratio

A stringent indicator of a company's short-term liquidity, calculated by dividing cash, marketable securities, and net receivables by current liabilities.

Receivables Turnover

A financial metric indicating how quickly a company collects on outstanding accounts receivable in a given period, calculated as net credit sales divided by average accounts receivable.

Debt Ratio

A financial ratio that compares the amount of a company's debt to its total assets, indicating the proportion of a company's assets that are financed through debt.

Q7: Dice Inc. owns 40% of the outstanding

Q14: A patient is tested to determine the

Q14: Which is a nucleic acid-based test?<br>A) CDC<br>B)

Q19: Virginia Corp. owned all of the voting

Q22: A polymerase enzyme with high processivity would

Q24: Perry Company acquires 100% of the stock

Q47: How does the partial equity method differ

Q58: Which of the following statements is true

Q67: Which of the following results in a

Q87: Elon Corp. obtained all of the common