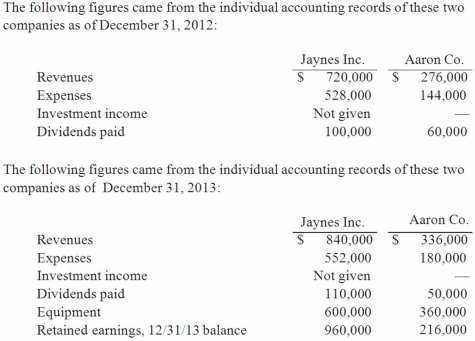

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2012, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What was consolidated net income for the year ended December 31, 2013?

Definitions:

Q4: The ability of a typing method to

Q7: Which test method is best for a

Q10: Acker Inc. bought 40% of Howell Co.

Q11: Perry Company acquires 100% of the stock

Q23: A reference segment of DNA has the

Q25: The specificity of the PCR reaction is

Q31: Acker Inc. bought 40% of Howell Co.

Q36: What are the benefits or advantages of

Q87: Stevens Company has had bonds payable of

Q98: Carnes has the following account balances as