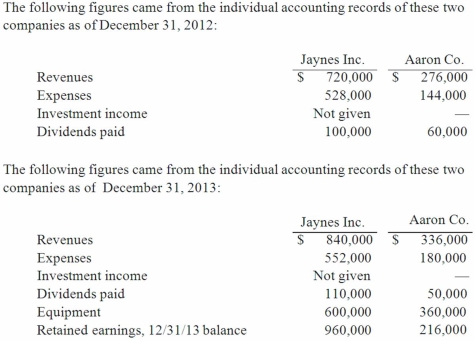

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2012, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What was consolidated equipment as of December 31, 2013?

Definitions:

Family Burden

The stress, difficulties, and challenges families experience due to the mental or physical illness of a family member.

Mental Illness

A broad term for a wide range of mental health conditions that affect mood, thinking, and behavior.

Adult Attention Deficit Hyperactivity Disorder (ADHD)

A neurodevelopmental condition characterized by patterns of hyperactivity, impulsiveness, and/or inattention, persisting into adulthood.

Plan of Care

A comprehensive, personalized strategy designed by healthcare professionals to address a patient's specific health needs and treatment goals.

Q5: Fertilization where one gamete contains an extra

Q14: On January 1, 2014, Jannison Inc. acquired

Q16: When consolidating a subsidiary under the equity

Q21: Starting with a single target, how many

Q22: Which of the following methods used to

Q52: Presented below are the financial balances for

Q56: Thomas Inc. had the following stockholders' equity

Q70: On January 1, 2013, Jackie Corp. purchased

Q78: Which one of the following characteristics of

Q115: Watkins, Inc. acquires all of the outstanding