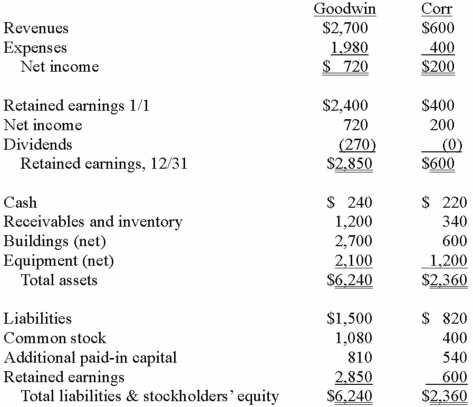

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated expenses for 2013.

Definitions:

Database

A collection of related files or tables containing data.

Data Hierarchy

A systematic organization of data often in a hierarchical form ranging from bits and bytes up to databases.

Byte

A unit of digital information that most commonly consists of eight bits, representing a single character of data in most computer systems.

Database

An organized collection of structured information, or data, typically stored electronically in a computer system.

Q8: A melt curve analysis was performed to

Q18: Which of the following is the molecular

Q23: The level of detail to which an

Q25: A patient is being tested to determine

Q25: Which of the following targets is tissue

Q26: Gargiulo Company, a 90% owned subsidiary of

Q38: When comparing the difference between an upstream

Q43: Presented below are the financial balances for

Q110: On January 3, 2013, Roberts Company purchased

Q127: Several years ago Polar Inc. acquired an