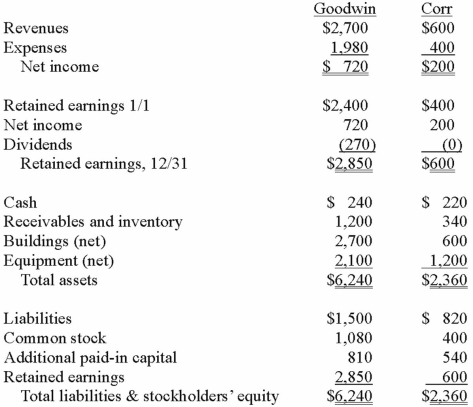

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consideration transferred for this acquisition at December 31, 2013.

Definitions:

Postbox Rule

A legal principle that deems an offer as accepted once the acceptance has been posted, even if it is never received by the offeror.

Electronic Mail

A method of exchanging messages digitally through the internet or other computer networks.

Communication Means

Various methods or systems used to convey information or messages from one person or entity to another.

Binding Contract

An agreement legally recognized and enforceable by law.

Q8: What enzyme system is used to avoid

Q10: Which of the following conditions are the

Q12: Ten equivalents of a genome were cut

Q20: What is an expression for how many

Q24: Mice with compromised immune systems are still

Q24: When a parent uses the initial value

Q70: On January 1, 2013, Pride, Inc. acquired

Q96: A parent company owns a controlling interest

Q97: When is a goodwill impairment loss recognized?<br>A)

Q103: Clemente Co. owned all of the voting