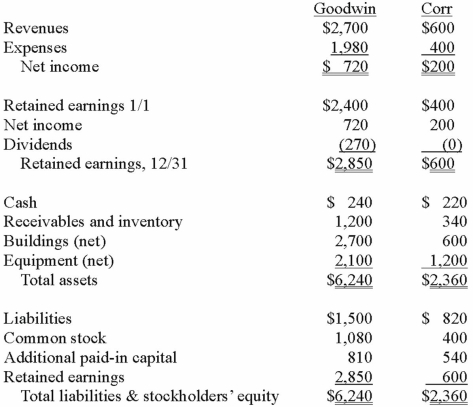

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the goodwill arising from this acquisition at December 31, 2013.

Definitions:

CEO

Chief Executive Officer; the highest-ranking person in a company or organization, responsible for making overarching decisions.

Naming a Successor

The process of identifying and appointing an individual to take over a role or position after the current holder leaves or retires.

Key Executive

A high-ranking individual in a company who has significant responsibility for managing an essential part of the business.

Operating Performance

An analysis of a company's efficiency and effectiveness in managing its resources and operations, often assessed through metrics like return on investment, profit margins, and productivity levels.

Q4: What is TaqMan?<br>A) A qPCR probe system<br>B)

Q12: Pepe, Incorporated acquired 60% of Devin Company

Q18: Which of the following statements is true

Q24: Which is a frameshift mutation?<br>A) Loss of

Q46: Cashen Co. paid $2,400,000 to acquire all

Q55: On January 1, 2012, Franel Co. acquired

Q81: What is preacquisition income?

Q82: Prior to being united in a business

Q102: All of the following are acceptable methods

Q104: When the fair value option is elected