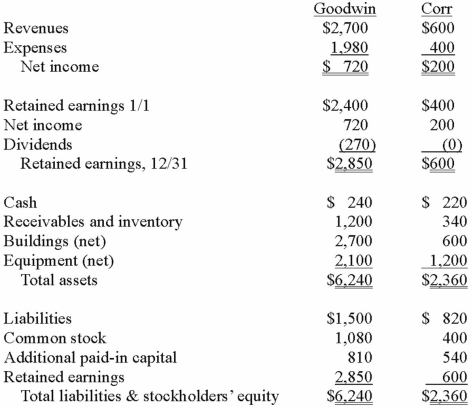

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated additional paid-in capital at December 31, 2013.

Definitions:

Powerful Individuals

Persons who hold significant influence or authority over others in a societal context, shaping decisions, norms, and values.

Ethics Issues

Problems or situations that require individuals or organizations to choose between actions that must be evaluated as right or wrong, often involving moral dilemmas.

Milgram's Study

A series of psychological experiments conducted by Stanley Milgram, which aimed to measure the willingness of participants to obey an authority figure who instructed them to perform acts conflicting with their personal conscience.

Cross-Cultural Research

Studies that compare aspects of two or more cultures to understand their differences and similarities.

Q3: Mutation in this gene product that catalyzes

Q4: Li-Fraumeni syndrome, in which affected patients have

Q7: Which of the following laboratory methods will

Q12: Ten equivalents of a genome were cut

Q15: A linear molecule has two sites for

Q24: What is the proper way to handle

Q38: McGuire Company acquired 90 percent of Hogan

Q39: When a company applies the partial equity

Q43: Which of the following statements is true

Q102: When a parent uses the acquisition method