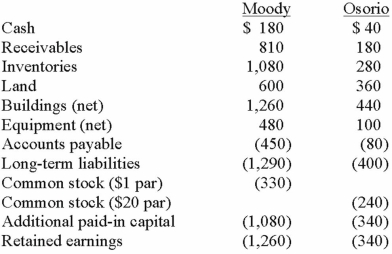

On January 1, 2013, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated inventories at date of acquisition.

Definitions:

Ad Substantiation

An FTC standard requiring that advertisers have a reasonable basis for the claims made in their ads.

Reasonable Basis

A concept often used in law and regulations, referring to a well-founded rationale for decisions or actions.

Cease and Desist Order

A legal order issued by a government agency or court ordering a person or entity to stop engaging in a particular activity or behavior.

Half-Truth

Information that is true but is not complete.

Q3: A fax report of patient results is

Q8: On January 1, 2014, Palk Corp. and

Q21: Which are only expressed constitutively on "professional

Q22: Genetic analysis of four generations of a

Q26: Gargiulo Company, a 90% owned subsidiary of

Q50: What is the difference in consolidated results

Q55: How does the existence of a non-controlling

Q69: Wilson owned equipment with an estimated life

Q88: Gargiulo Company, a 90% owned subsidiary of

Q107: McGuire Company acquired 90 percent of Hogan