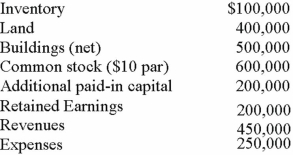

Carnes has the following account balances as of May 1, 2012 before an acquisition transaction takes place.  The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2012, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2012, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

What will be Riley's balance in its common stock account as a result of this acquisition?

Definitions:

Foreign Currency

Currency used in a country other than one's own, necessitating exchange for transactions or investments in foreign markets.

Direct Quote

An exchange value described as the amount of local currency required for a single unit of a foreign currency.

Indirect Quote

A foreign exchange rate quoted as the foreign currency per unit of domestic currency.

Mexican Pesos

The currency of Mexico, abbreviated as MXN, used for all financial transactions within the country.

Q14: Flynn acquires 100 percent of the outstanding

Q16: A PCR assay is performed on a

Q19: Following are selected accounts for Green Corporation

Q21: Starting with a single target, how many

Q25: The specificity of the PCR reaction is

Q69: Wilson owned equipment with an estimated life

Q75: Wilson owned equipment with an estimated life

Q91: Utah Inc. acquired all of the outstanding

Q93: What argument could be made against the

Q94: Pursley, Inc. owns 70 percent of Harry