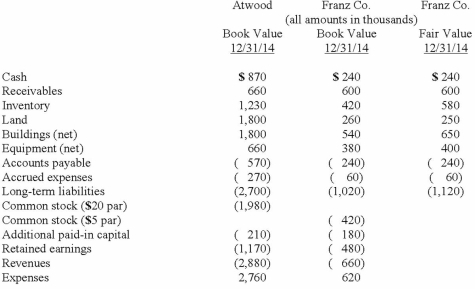

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2012, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2012. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated expenses at date of acquisition.

Definitions:

Wheat

A cereal grain that is a worldwide staple food, known for its application in various foods like bread, pasta, and more.

Milk

A nutritious white liquid produced by the mammary glands of mammals, widely consumed as a beverage or used as an ingredient in cooking.

Utility Function

A representation in economics that captures a consumer's preference by assigning a utility value to different bundles of goods.

Pareto Optimal

A condition in resource allocation where it's unachievable to improve the standing of any party without detrimentally impacting another party or criterion of choice.

Q6: HLA specificities were first defined in the

Q11: What are the structures found only at

Q14: The functions of which of the following

Q16: Comparative genome hybridization detects which type of

Q17: A protein with the sequence DAILMNCST is

Q20: Which of the following translocations is associated

Q32: Thomas Inc. had the following stockholders' equity

Q37: When consolidating a subsidiary under the equity

Q70: On January 1, 2013, Pride, Inc. acquired

Q91: Utah Inc. acquired all of the outstanding