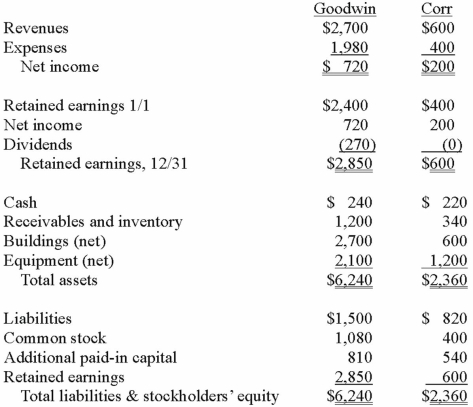

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

In this acquisition business combination, what total amount of common stock and additional paid-in capital is added on Goodwin's books?

Definitions:

Inventory

The range of products or goods that are held by a business for the purpose of resale, crucial for operations and financial health.

Working Capital Assets

Current assets that are used in the operation of a business and can be converted into cash within a year.

Net Working Capital

The difference between a company's current assets and its current liabilities, indicating the short-term financial health and operational efficiency.

Spontaneous Financing

Financing that occurs naturally as a company operates, such as trade credit that increases as sales increase.

Q1: The mutation del(15)(q11q13) on the paternal chromosome

Q3: What is the purpose of an amplification

Q4: The ability of a typing method to

Q14: A PCR reaction that uses more than

Q25: The specificity of the PCR reaction is

Q32: When should an investor not use the

Q35: Thomas Inc. had the following stockholders' equity

Q37: On January 4, 2012, Trycker, Inc. acquired

Q53: On January 1, 2014, Glenville Co. acquired

Q85: Club Co. appropriately uses the equity method