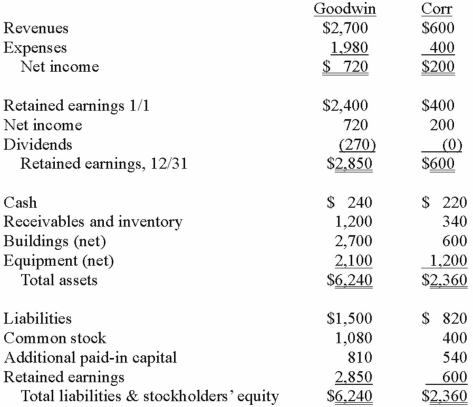

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated cash account at December 31, 2013.

Definitions:

RC Parallel Circuit

An electrical circuit that consists only of a resistor (R) and a capacitor (C) connected in parallel, affecting the overall impedance and phase angle.

RC Parallel Circuit

A type of electrical circuit where resistor(s) and capacitor(s) are connected in parallel, affecting the charging and discharging rate of the capacitor.

Capacitive Reactance

Opposition to AC flow in capacitors, varying inversely with the frequency of the operation and the capacitance value.

Supply Voltage

The voltage provided by a power source to operate electrical or electronic equipment.

Q4: Under the partial equity method of accounting

Q15: Which of the following is the correct

Q18: Perry Company acquires 100% of the stock

Q29: Five one- and two-base repeat loci were

Q45: Atlarge Inc. owns 30% of the outstanding

Q52: Harrison, Inc. acquires 100% of the voting

Q57: How is contingent consideration accounted for in

Q73: On January 1, 2012, Jumper Co. acquired

Q76: Which one of the following is a

Q100: Perch Co. acquired 80% of the common