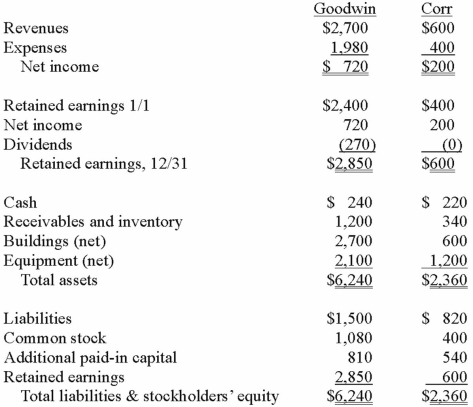

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consideration transferred for this acquisition at December 31, 2013.

Definitions:

Clinical Inferences

The conclusions or judgments that healthcare professionals make based on clinical data, observations, and patient information.

Appendectomy

A surgical procedure to remove the appendix when it is inflamed or infected.

Pediatric Nurse

A nurse specializing in the care of children and adolescents, addressing both their physical and emotional needs.

Clinical Inference

The process through which healthcare providers draw conclusions about a patient's condition based on observed data, clinical experience, and scientific evidence.

Q7: Virginia Corp. owned all of the voting

Q19: Following are selected accounts for Green Corporation

Q21: On January 3, 2013, Austin Corp. purchased

Q31: Under the partial equity method, the parent

Q55: Chain Co. owned all of the voting

Q59: Which statement is true concerning unrealized profits

Q81: Gargiulo Company, a 90% owned subsidiary of

Q85: The financial statements for Goodwin, Inc. and

Q109: On January 1, 2014, Jannison Inc. acquired

Q115: Gargiulo Company, a 90% owned subsidiary of