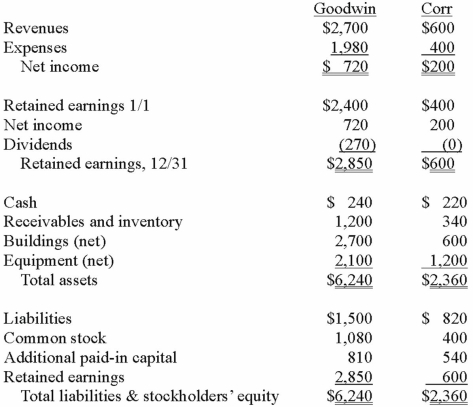

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the goodwill arising from this acquisition at December 31, 2013.

Definitions:

Income Distribution

The distribution of total earnings among individuals within a society.

More Equal

A phrase describing a reduction in disparities or inequalities, typically in contexts related to income, wealth, or opportunities.

Wealth Distribution

The manner in which wealth is distributed among the individuals in a society.

Income Inequality

Income inequality describes the extent to which income is distributed unevenly among a population.

Q2: Pot Co. holds 90% of the common

Q15: How are intra-entity inventory transfers treated on

Q16: A woman has been sexually assaulted by

Q19: A PCR assay using primers specific for

Q21: Which of the following translocations can be

Q26: Dodge, Incorporated acquires 15% of Gates Corporation

Q27: This test is used to determine if

Q27: Charlie Co. owns 30% of the voting

Q102: When a parent uses the acquisition method

Q113: Why is push-down accounting a popular internal