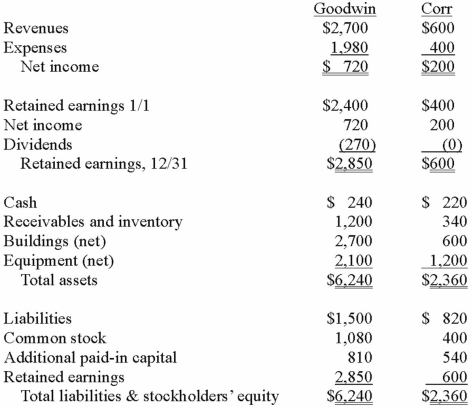

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated additional paid-in capital at December 31, 2013.

Definitions:

Order

A request by a customer for a company to provide goods or services at a specified price and time.

Account Balance

The total amount of money in a financial account, calculated by adding all credits and subtracting all debits.

Credits

Accounting entries that increase liabilities or decrease assets, typically reflecting the sources of value in transactions.

Accounts Payable

Liabilities to creditors arising from purchases of goods, services, or loans, representing amounts a company owes and must pay in the near term.

Q5: HIV genotyping is performed for which of

Q7: Which of the following molecular-based methods can

Q36: Gargiulo Company, a 90% owned subsidiary of

Q42: Parent Corporation loaned money to its subsidiary

Q53: Jansen Inc. acquired all of the outstanding

Q70: According to the FASB ASC regarding the

Q89: Which types of transactions, exchanges, or events

Q108: Tosco Co. paid $540,000 for 80% of

Q115: Watkins, Inc. acquires all of the outstanding

Q118: Tara Company owns 80 percent of the