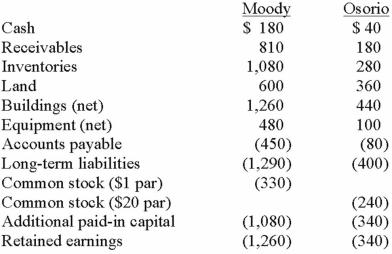

On January 1, 2013, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated additional paid-in capital at date of acquisition.

Definitions:

Perfect Competitors

Firms in a market structure characterized by many sellers offering identical products, where no single seller can influence market prices.

Monopolistic Competitors

Firms operating in a market structure characterized by many firms selling products that are similar but not identical, allowing for some degree of market power.

Minimum ATC

The lowest point on the Average Total Cost curve, where a firm is most efficient in its production.

Monopolistically Competitive

A market structure characterized by many sellers offering similar but not identical products, allowing for some control over pricing and competition based on product differentiation.

Q6: In a C banding pattern, what part

Q8: The microarray or chip is an example

Q16: When consolidating a subsidiary under the equity

Q21: On January 3, 2013, Austin Corp. purchased

Q23: In the interpretation of pulsed field gel

Q62: On January 1, 2011, Rand Corp. issued

Q72: All of the following statements regarding the

Q84: Norek Corp. owned 70% of the voting

Q89: Which types of transactions, exchanges, or events

Q114: Dodge, Incorporated acquires 15% of Gates Corporation