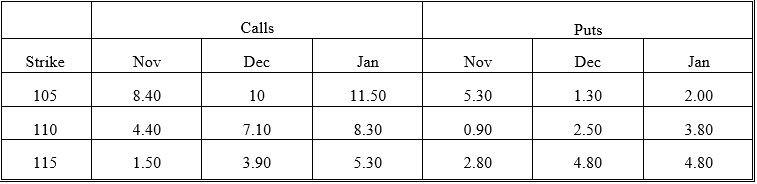

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-What is the intrinsic value of the November 105 put?

Definitions:

Spontaneous Recovery

The reappearance of a previously extinguished response after a period of no exposure to the conditioned stimulus.

Respondent Behavior

Behavior that occurs as a direct response to a specific stimulus, often reflexive or involuntary in nature.

Classical Conditioning

A learning process in which a biologically potent stimulus is paired with a previously neutral stimulus to elicit a conditioned response.

Negative Reinforcement

A behavioral principle where the removal or avoidance of an unpleasant stimulus increases the likelihood of a behavior being repeated.

Q4: In the lactose operon, which of the

Q5: What will be the cost of the

Q12: An American call on a non-dividend paying

Q12: Substitution of leucine with valine in an

Q13: The quality option is sometimes referred to

Q19: A patient is suspected of having follicular

Q21: In a two-period binomial world, a mispriced

Q32: Each futures contract has both a long

Q38: What is the net present value of

Q53: The spread between the bid price and