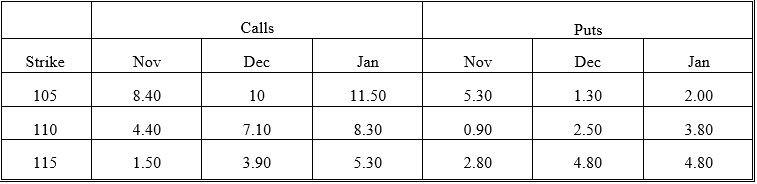

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-What is the time value of the November 115 put?

Definitions:

Static Budget

A budget that remains unchanged over the budget period and is not adjusted for actual levels of activity.

Flexible Budget

A budget that adjusts or varies with changes in the volume of activity, production levels, or other operational factors.

Direct Materials

Raw materials that can be directly traced to the production of goods or services and are considered variable costs.

Fixed Utilities

Charges for basic services like electricity, water, and gas that do not fluctuate greatly with usage levels, often considered part of an organization's fixed overhead.

Q14: What would be observed in the event

Q15: STR analysis is performed on bone marrow

Q18: If the binomial model describes the real

Q22: Which of the following statements about the

Q24: The binomial option pricing formula will conform

Q26: A patient's diagnosis is ataxia-telangiectasia. The physician

Q29: The payoffs form a straddle are more

Q30: The holder of a straddle does not

Q45: Who determines whether options on a company's

Q58: Selling a put is a bullish strategy