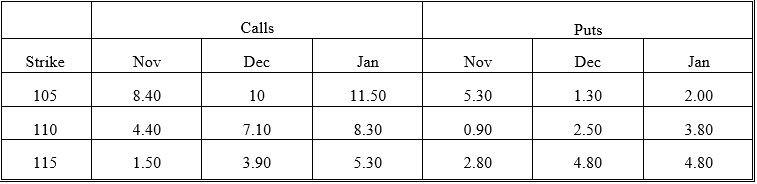

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-From American put-call parity,what are the minimum and maximum values that the sum of the stock price and December 110 put price can be?

Definitions:

Opportunity Cost

The loss incurred by rejecting the immediate best alternative when arriving at a decision.

Fix A Meal

The process of preparing and cooking a meal.

Better Off

A term indicating an improvement in condition or well-being, often referring to economic improvement or increased welfare.

Constant Rate

A fixed rate at which something occurs or is applied over a particular period of time.

Q14: What was the great advantage to molecular

Q14: Hydrolysis of the finished polypeptide from the

Q16: A pedigree was examined over four generations

Q19: A patient is suspected of having follicular

Q23: The 260 nm/280 nm ratio for isolated

Q23: Normal backwardation and contango are mutually exclusive

Q28: In sexual recombination, new combinations of genes

Q35: Holding everything else constant, a longer-term European

Q52: The earliest financial futures contracts were futures

Q54: Holding everything else constant, dividends or interest