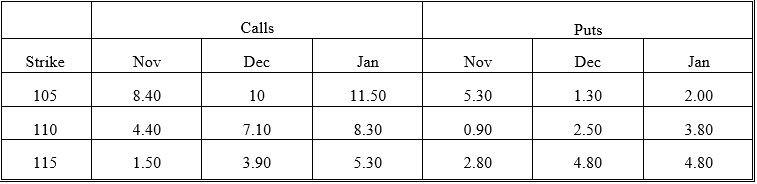

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-The maximum difference between the January 105 and 110 calls is which of the following?

Definitions:

Q6: If there is one period remaining and

Q10: Which of the following methods is best

Q14: In a DNA molecule, one end has

Q16: A pedigree was examined over four generations

Q20: Which of the following enzyme/substrate combinations is

Q25: A limit move is when a futures

Q26: What intermediary guarantees an option writer's performance?<br>A)

Q33: The Black-Scholes-Merton formula requires cumulative probabilities from

Q56: What is the current value of the

Q60: Given a longer-lived American call and a