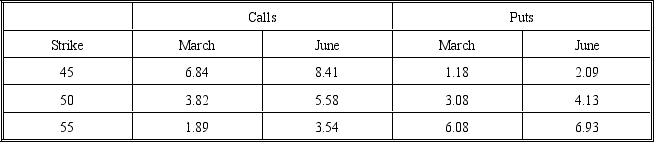

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated.

For questions 1 through 6,consider a bull money spread using the March 45/50 calls.

-How much will the spread cost?

Definitions:

Important Resource

A crucial element or input required for the production process or societal functioning.

Immigration

The action of coming to live permanently in a foreign country.

Demand Curve

A graphical representation showing the relationship between the price of a good and the quantity demanded by consumers at those prices.

Consumer Income

Refers to the total earnings received by consumers, including wages, salaries, benefits, and any other income sources, influencing their purchasing power and spending behaviors.

Q10: Determine the value of an interest rate

Q10: A spread that is profitable if the

Q10: Currency swaps can be viewed as a

Q11: DNA contains deoxyribonucleotide triphosphates joined together by

Q19: The codons that do not code for

Q25: In the real-world, financial decisions are irrelevant,

Q31: Which of the following assumptions of the

Q33: The profit from a put bear spread

Q40: An FRA differs from an interest rate

Q41: What is the intrinsic value of the