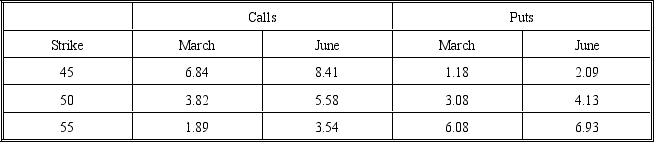

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated.

For questions 1 through 6,consider a bull money spread using the March 45/50 calls.

-What is the maximum profit on the spread?

Definitions:

Home Currency Approach

A method of evaluating foreign investments or earnings by converting them into the investor’s domestic currency.

Foreign Currency Approach

It refers to the methodology used in financial analysis or accounting to evaluate transactions and operations in currencies other than the primary currency of the entity.

Capital Budgeting

The process used by organizations to evaluate and select long-term investments that are in line with the firm's goal of wealth maximization.

Uncovered Interest Parity

A theory suggesting that the difference in interest rates between two countries is equal to the expected change in their exchange rates.

Q2: Which of the following is the lowest

Q3: What is the yield of DNA from

Q3: Find the forward rate of foreign currency

Q4: A contingent-pay option allows the holder to

Q14: The exchange with the largest share of

Q28: If you buy both a 30-day Eurodollar

Q29: Which of the following best describes normal

Q35: Which of the following investors may be

Q47: The lower the exercise price, the more

Q59: The lower bound of a European put