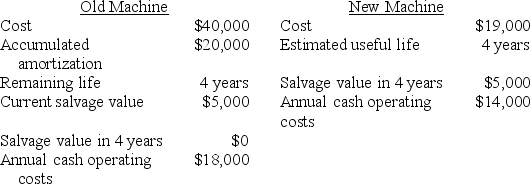

Bailey Corporation is considering modernizing its production by purchasing a new machine and selling an old machine. The following data have been collected on this investment:  The income tax rate is 40%, and the required rate of return is 16%. Amortization is $5,000 per year for the old machine. The new machine would be amortized $7,600 in 20x1, $5,700 in 20x2, $3,800 in 20x3, and $1,900 in 20x4. Assume Bailey would purchase the new machine in December 20x0 and dispose of the old machine in January 20x1.

The income tax rate is 40%, and the required rate of return is 16%. Amortization is $5,000 per year for the old machine. The new machine would be amortized $7,600 in 20x1, $5,700 in 20x2, $3,800 in 20x3, and $1,900 in 20x4. Assume Bailey would purchase the new machine in December 20x0 and dispose of the old machine in January 20x1.

Bailey's 20x0 amortization tax shield for the old machine is:

Definitions:

U.S. Dollar

The recognized money of the United States, extensively utilized as a standard and reserve currency globally.

Currency Depreciation

A decrease in the value of one currency relative to another currency in the foreign exchange market.

Foreign Exchange Market

A global trading space for the exchange of different countries' currencies.

Imports

Goods or services brought into one country from another for sale, often subject to tariffs, quotas, and trade agreements.

Q18: A joint input costing $500 results in

Q37: Everett, Inc. budgeted $1,488,000 for total overhead.

Q41: Problems with market-based transfer prices include:<br>A)Lack of

Q45: Which of the following is the main

Q49: The direct manufacturing labour budget:<br>I. Is stated

Q52: Life cycle costing is used when a

Q75: Kaizen costing and target costing are two

Q77: Clark and Lana are product managers at

Q121: Horton Company produces and sells two products:

Q139: HGT Corporation produces four products from a