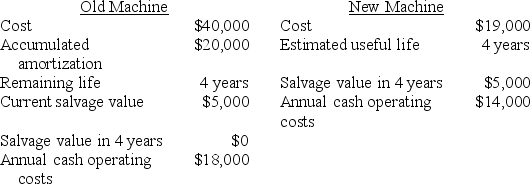

Bailey Corporation is considering modernizing its production by purchasing a new machine and selling an old machine. The following data have been collected on this investment:  The income tax rate is 40%, and the required rate of return is 16%. Amortization is $5,000 per year for the old machine. The new machine would be amortized $7,600 in 20x1, $5,700 in 20x2, $3,800 in 20x3, and $1,900 in 20x4. Assume Bailey would purchase the new machine in December 20x0 and dispose of the old machine in January 20x1.

The income tax rate is 40%, and the required rate of return is 16%. Amortization is $5,000 per year for the old machine. The new machine would be amortized $7,600 in 20x1, $5,700 in 20x2, $3,800 in 20x3, and $1,900 in 20x4. Assume Bailey would purchase the new machine in December 20x0 and dispose of the old machine in January 20x1.

The relevant annual pretax cash operating cost associated with Bailey's decision will be:

Definitions:

Q49: If Erika Lee invests $5,000 in a

Q54: Kelita, Inc., projects sales for its first

Q102: The budgeted income statement:<br>I. Accumulates information from

Q102: Appendix 12A)Which of the following NPV analysis

Q112: Discuss the similarities and differences between annual

Q115: J-M Company uses a joint process costing

Q125: Exeter Mfg. Co. introduced a new mass-produced

Q142: In throughput costing, direct labour and variable

Q147: Hogle Mfg. Co. uses a standard costing

Q155: During the period Richeleau produced 1,000 units