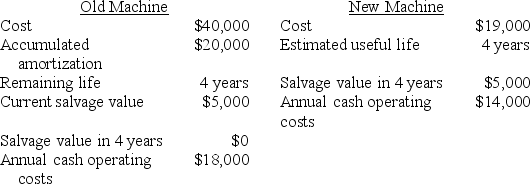

Bailey Corporation is considering modernizing its production by purchasing a new machine and selling an old machine. The following data have been collected on this investment:  The income tax rate is 40%, and the required rate of return is 16%. Amortization is $5,000 per year for the old machine. The new machine would be amortized $7,600 in 20x1, $5,700 in 20x2, $3,800 in 20x3, and $1,900 in 20x4. Assume Bailey would purchase the new machine in December 20x0 and dispose of the old machine in January 20x1.

The income tax rate is 40%, and the required rate of return is 16%. Amortization is $5,000 per year for the old machine. The new machine would be amortized $7,600 in 20x1, $5,700 in 20x2, $3,800 in 20x3, and $1,900 in 20x4. Assume Bailey would purchase the new machine in December 20x0 and dispose of the old machine in January 20x1.

The tax effect of selling the new machine in 20x4 would be:

Definitions:

Occupational Area

A field or sector of work or profession.

Physical Separation

The act of being apart from others in space or distance, which can affect relationships and mental health.

Nonverbal Communication

The transfer of information through body movements, expressions, and gestures, rather than spoken words.

Coded Words

Language that conveys a particular meaning not explicitly stated, often used to disguise the true message or to communicate with a specific audience.

Q1: Managers should choose a joint cost allocation

Q35: (Appendix 12A)Professor Mills is thinking about publishing

Q35: Theoretical capacity reflects:<br>A)Actual capacity levels<br>B)The capacity level

Q49: Dyggur Traders wishes to earn a 20%

Q49: If Erika Lee invests $5,000 in a

Q63: Canton Corp. plans to produce 30,000 units

Q75: Baylor, Inc. just finished its second year

Q109: The steps in making capital budgeting decisions

Q126: Budgets are used to:<br>I. Forecast future performance<br>II.

Q164: TNR Corporation is preparing its budgeted income