The following information pertains to questions

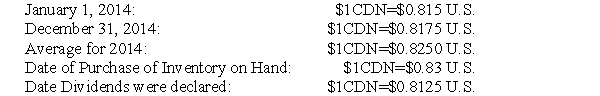

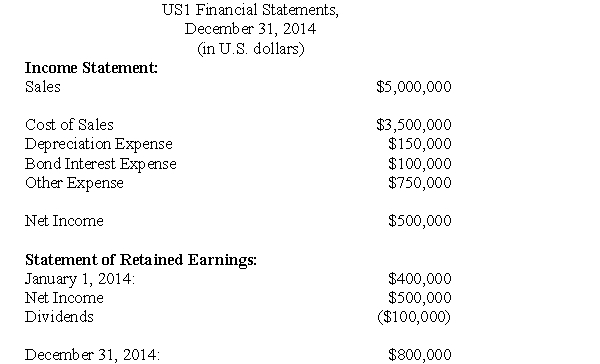

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

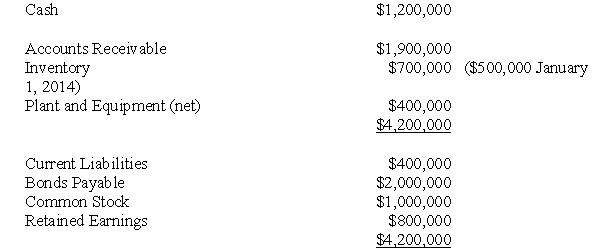

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-Which of the following rates would be used to translate the company's sales?

Definitions:

Accounting

is the systematic recording, reporting, and analysis of financial transactions of a business or individual.

Dividend Income

Income received from owning shares in a company, which is often taxable at different rates than regular income.

Distribution

The action of sharing something out among a number of recipients, often used in the context of financial assets or dividends.

Transferors Own 80%

A situation in a business transaction where the original owners or transferors retain an 80% ownership interest in the property or entity after the transaction is completed.

Q28: Approximately what percentage of the non-controlling interest

Q31: Prepare Alcor's Consolidated Balance Sheet as at

Q39: What is the amount of cash (in

Q45: What would be the journal entry to

Q49: Explain how scatter plots are used in

Q70: Harmel, Inc. incurs the following costs each

Q100: The margin of safety is the:<br>A)Volume of

Q117: The Nunn Co. produces a single product.

Q127: Data extracted from the accounting information system

Q163: Jackie's Kennels is located in a small