The following information pertains to questions

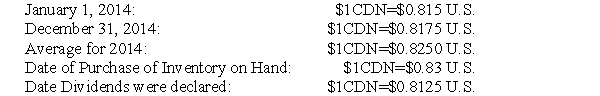

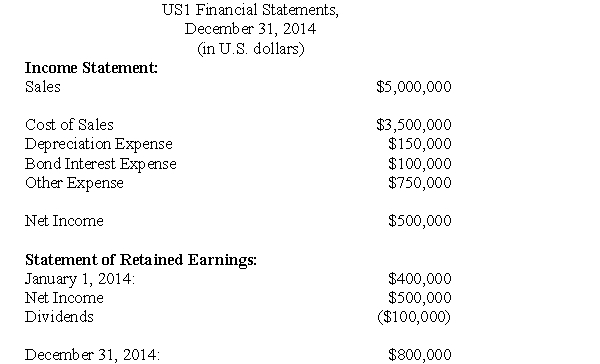

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

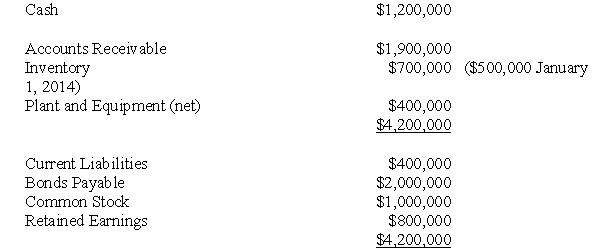

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-Which of the following rates would be used to translate the company's beginning retained earnings?

Definitions:

Equal Distribution

The concept of distributing resources or income in a way that every member of a society gets an equal share.

Marginal Cost

The expense incurred from the manufacture of an extra single unit of a product or service.

Opportunity Cost

The expense incurred from not choosing the second-best option available during decision-making.

Marginal Cost

The swell in aggregate expenditure due to the production of an additional unit of a product or service.

Q6: Which of the following was NOT a

Q17: ABC invested $30 million in cash

Q23: How are intercompany transactions handled in a

Q24: The breakeven point can be defined as:<br>A)The

Q36: In regression analysis, the Adjusted R-square statistic

Q45: Consolidated Net Income is equal to<br>A)the sum

Q46: If we want to estimate the cost

Q60: Which of the following statements best describes

Q115: Cosby Company is attempting to develop the

Q167: Information from CVP analysis helps with all