The following information pertains to questions

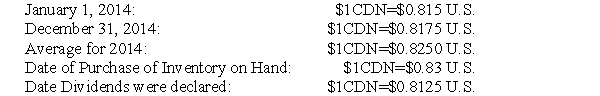

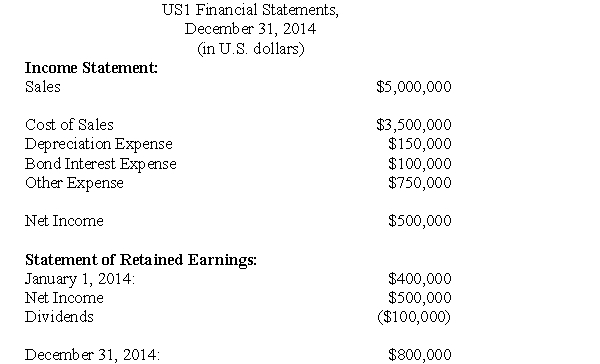

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

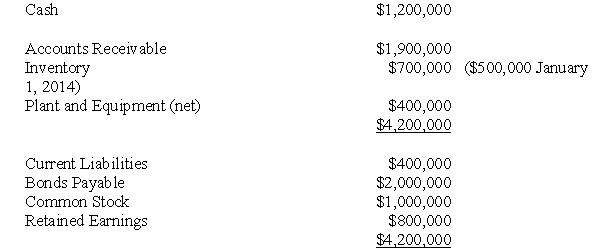

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-Which of the following rates would be used to translate the company's Cash?

Definitions:

Variable Overhead Spending Variance

The difference between actual variable overhead costs and the budgeted costs for the actual level of activity, indicating overspending or underspending.

Labour Efficiency Variance

The difference between the budgeted labor hours or costs and the actual labor hours or costs incurred.

Variable Overhead Efficiency Variance

The difference between the actual variable overhead based on hours worked and the standard cost of variable overhead for those hours.

Q7: Assuming the subsidiary showed a profit for

Q14: What is the amount of interest paid

Q24: How much Goodwill was amortized during 2003?<br>A)$700<br>B)($1,700)<br>C)$1,700<br>D)None

Q26: Company A Inc.owns a controlling interest in

Q55: Maude is considering opening her own business,

Q55: By how much would the non-controlling interest

Q58: What would be the net income reported

Q82: (CMA)When comparing strategic planning with operational planning,

Q98: During 20x1, Advanced Systems introduced complex oil

Q136: EDC Corporation sells a single product for