The following information pertains to questions

On January 1,2011,Larmer Corp.(a Canadian company)purchased 80% of Martin Inc,an American company,for $50,000 U.S.

Martin's book values approximated its fair values on that date except for plant and equipment,which had a fair market value of $30,000 U.S.with a remaining life expectancy of 5 years.A goodwill impairment loss of $1,000 U.S.occurred during 2011.

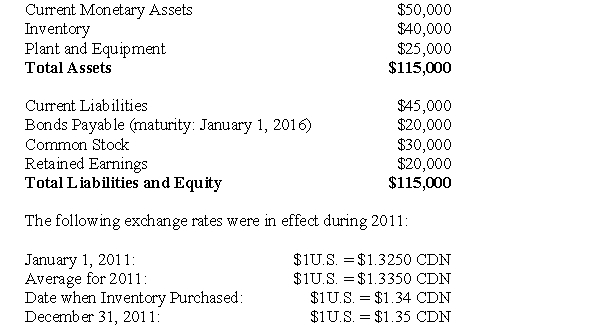

Martin's January 1,2011 Balance Sheet is shown below (in U.S.dollars):  Dividends declared and paid December 31,2011

Dividends declared and paid December 31,2011

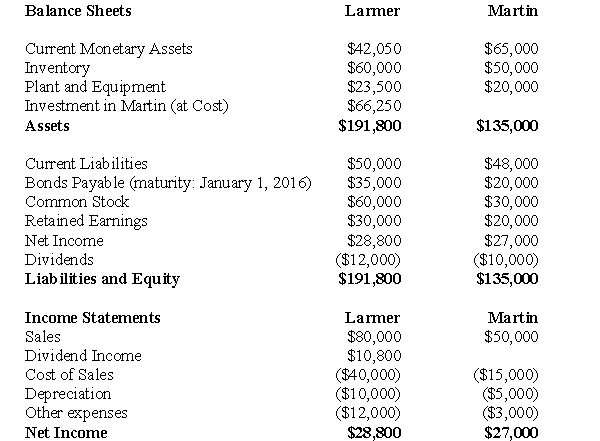

The financial statements of Larmer (in Canadian dollars)and Martin (in U.S.dollars)are shown below:  For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

-Translate Martin's 2011 Income Statement into Canadian dollars.

Definitions:

Social Exchange

Social exchange is a theory that suggests human relationships are formed based on a subjective cost-benefit analysis and the comparison of alternatives.

Diffusion of Responsibility

The phenomenon where individuals in a group are less likely to take action or feel accountable because responsibility is shared among all members.

Mortality Reminder

Involves cues or events that bring thoughts of death and one's mortality to the forefront of consciousness, often impacting behaviors and attitudes.

Ingroup Member

An individual who belongs to and identifies with a particular group or category that is distinct from others.

Q6: Company A owns all of the outstanding

Q9: Discuss the disclosure requirements for long term

Q14: Assuming that A acquired a controlling interest

Q19: A scatter plot is especially useful when

Q28: Tom is gathering information about buying a

Q38: What would be the amount of the

Q56: The trend line from a scatter plot

Q70: Incremental cash flows are the same as

Q98: During 20x1, Advanced Systems introduced complex oil

Q154: Variable costs:<br>A)Do not vary in total within