The following information pertains to questions

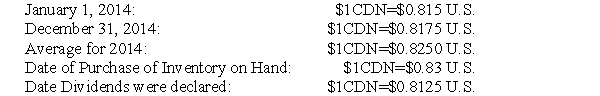

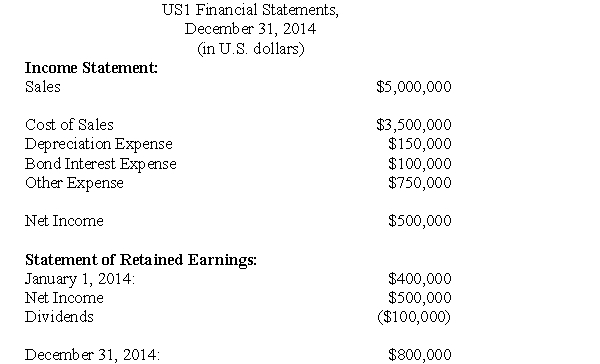

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

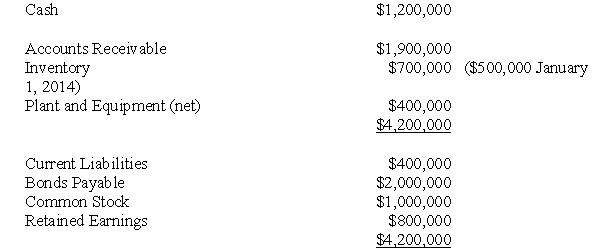

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-Which of the following rates would be used to translate the company's Common Stock?

Definitions:

Direct Labor-Hours

A measure of the total hours worked by employees directly involved in the production process, used for costing and efficiency analysis.

Manufacturing Overhead

All indirect costs associated with manufacturing, excluding direct materials and direct labor, such as utilities, depreciation, and maintenance of factory equipment.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to products or services.

Manufacturing Cost

All expenses directly related to the production of goods, including raw materials, labor, and factory overhead.

Q4: Calculate Consolidated Retained Earnings as at June

Q5: At the balance sheet date,monetary items denominated

Q15: The Shareholder Equity section of Parent's Consolidated

Q20: Excluding any goodwill impairment losses,what would be

Q22: What is the amount of the acquisition

Q44: Using Push Down accounting is:<br>A)permissible under IFRSs.<br>B)is

Q85: Relevant cash flows are<br>A)Avoidable<br>B)Incremental<br>C)Both of the above<br>D)None

Q141: Trimex Corporation manufactures desk lamps. The following

Q143: Which of the following methods of estimating

Q165: All of the following are true about