The following information pertains to questions

On December 31,2013,Hilman Enterprises of Montreal paid $12,000,000 for 100% of the outstanding shares of Wilsen Corp of the United States.Wilsen's fair values approximated its book values on that date.

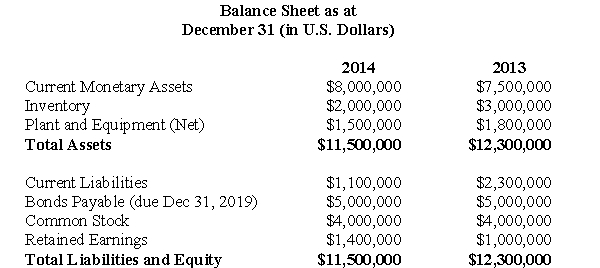

Wilsen's comparative balance sheets for 2013 and 2014 are shown below:

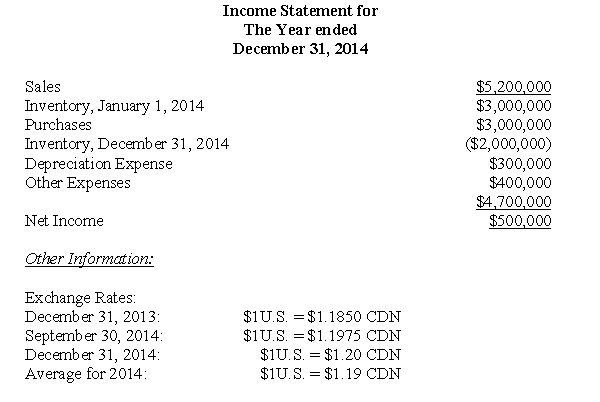

Wilsen paid U.S.$100,000 in dividends on September 30,2014.

Wilsen paid U.S.$100,000 in dividends on September 30,2014.

The inventories on hand at the end of 2014 were purchased when the exchange rate was

$1U.S.= $1.195 CDN.

For questions 42 through 45 inclusively,assume that Wilsen is considered to be an integrated subsidiary.

-Calculate the exchange gain or loss that would result from the translation of Wilsen's Financial Statements.

Definitions:

Appreciate the Dollar

The increase in value of the US dollar relative to other currencies, leading to increased purchasing power internationally.

Demand for Pesos

The desire or willingness of market participants to acquire Mexican pesos, influenced by factors like investment returns and currency stability.

Supply of Pesos

The total amount of Mexican Pesos available in the financial markets, influenced by factors such as monetary policy and economic conditions.

Exchange Rate

The rate at which one currency can be exchanged for another, influencing international trade and investments.

Q14: SXF Corporation sells its single product for

Q17: The breakeven point for a service organization

Q44: Which of the following statements is correct?<br>A)If

Q46: Which of the following rates would be

Q49: Biases:<br>A)Inhibit anticipating all future conditions<br>B)Assist in the

Q54: Which of the following rates would be

Q58: What is the amount of Consolidated Retained

Q60: What is the required adjustment to ABC's

Q60: Bill, the controller of CRV Corporation, is

Q129: In a regression analysis for estimating a