The following information pertains to questions

On January 1,2011,Larmer Corp.(a Canadian company)purchased 80% of Martin Inc,an American company,for $50,000 U.S.

Martin's book values approximated its fair values on that date except for plant and equipment,which had a fair market value of $30,000 U.S.with a remaining life expectancy of 5 years.A goodwill impairment loss of $1,000 U.S.occurred during 2011.

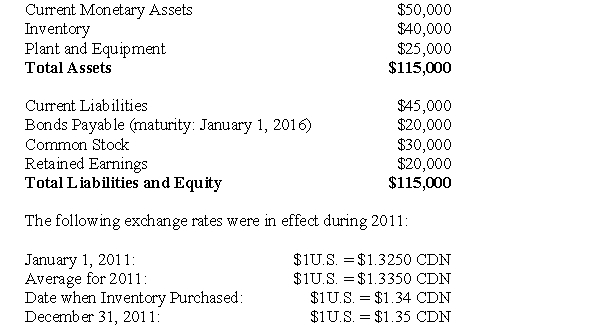

Martin's January 1,2011 Balance Sheet is shown below (in U.S.dollars):  Dividends declared and paid December 31,2011

Dividends declared and paid December 31,2011

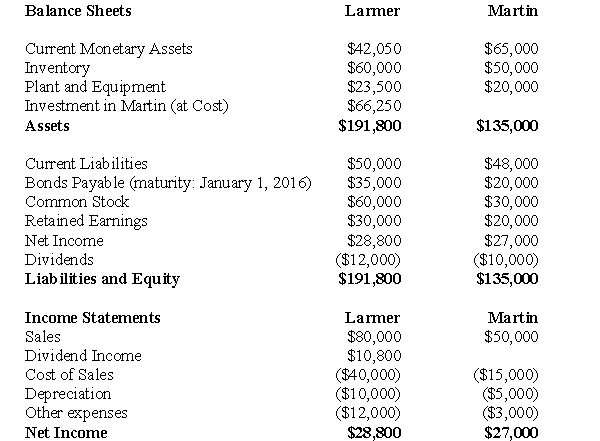

The financial statements of Larmer (in Canadian dollars)and Martin (in U.S.dollars)are shown below:  For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

For questions 50 through 53 inclusively,assume that Martin is an integrated foreign subsidiary.

-Compute Martin's exchange gain or loss for 2011.

Definitions:

Non-REM Sleep

A stage of sleep characterized by slower brain waves, reduced body movement, and absence of dreams, consisting of stages 1, 2, and deep stages 3 and 4.

Nightmares

Disturbing dreams that cause the dreamer to wake up feeling anxious and frightened.

REM Sleep

A stage of sleep characterized by rapid eye movements and is closely associated with vivid dreaming.

Postural Muscles

Muscles that are primarily responsible for maintaining posture and balance, enabling the body to stand upright and perform movements efficiently.

Q15: Which of the following statements regarding the

Q18: Compute Alcor's Consolidated Retained Earnings as at

Q25: Non-Controlling Interest is presented under the Liabilities

Q29: Calculate the non-controlling interest (Balance Sheet)as at

Q48: Harvey Enterprises expects sales of $1,000,000 and

Q64: Which of the following regarding the preparation

Q67: Few management decisions can be made with

Q72: Milano Company has an average overhead cost

Q88: A firm's production is expected to show

Q103: Accounting information is the only thing managers