The following information pertains to questions

Compucat is a Canadian manufacturing company that produces inexpensive personal and laptop computers.The company has been generating progressively more of its sales from foreign markets.During 2013,the company started purchasing most of its components from a supplier in Germany.

To deal with the uncertainty associated with foreign exchange fluctuations,all of Compucat's foreign currency denominated receivables and payables are hedged with contracts with the company's bank.Compucat's year-end is on December 31.The following transactions took place in 2013:

On September 1,2013,Compucat purchased components from its German supplier for 100,000 Euros.On that date AMC entered into a forward contract for 100,000 Euros at the 60 day forward rate of 1Euro=$1.50 CDN.Compucat paid its supplier in full on December 1,2013.

On December 1,2013 Compucat also shipped a batch of laptop computers to an American client for $250,000US.The invoice required that Compucat receive its payment in full by January 31,2013.On that date,the company entered into a forward contract for $250,000US at the two-month forward rate of $1US=$1.25CDN.

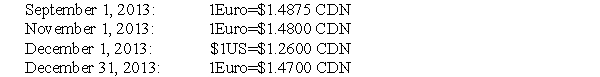

The dates and exchange rates relevant to these transactions are shown below.

-Prepare the December 31,2013 Balance Sheet Presentation of the Receivable from the American client and the accounts associated with the hedge.

Definitions:

Institutional Buyer

Organizations, such as companies, governments, or schools, that purchase goods or services in large quantities, often for internal use or resale.

Boston College

A private Jesuit research university located in Chestnut Hill, Massachusetts, known for its academic rigor and community engagement.

U.S. Marine Corps

A branch of the United States Armed Forces responsible for providing power projection, using the mobility of the United States Navy to rapidly deliver combined-arms task forces.

Gel Seats

Comfort-enhancing seats filled with gel padding used in various types of chairs and cushions, especially popular in bicycle seats.

Q7: Marginal cost is:<br>A)The average cost per unit<br>B)The

Q9: XYZ Inc.owns 55% of DEF's 100,000 outstanding

Q11: What is the TOTAL amount of CMI's

Q18: A manager might use this method to

Q21: Contingent consideration will be classified as a

Q30: The amount of deferred taxes appearing on

Q53: Which of the following statements is CORRECT?<br>A)Control

Q66: Managers can make higher-quality decisions by relying

Q69: One company is considering entering into a

Q163: Jackie's Kennels is located in a small