The following information pertains to questions

On July 1,2013,Great White North (GWN)Inc.purchased merchandise from a supplier in the U.S.for $800,000 with terms requiring full payment by October 31,2013.On July 2,GWN entered into a forward contract to purchase $800,000 U.S.on October 31,2013 at a rate of $1.2275CDN.

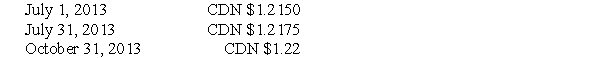

On October 31,GWN paid its supplier in full.Selected dates and spot rates are shown below:

-Prepare a July 31,2013 Partial Trial Balance,indicating how each Journal Entry would appear on the Financial Statements.

Definitions:

Book Value

The net value of a company's assets minus its liabilities and intangible assets, as recorded on the balance sheet.

Stock Split

A stock split is a corporate action where a company divides its existing shares into multiple shares to boost the liquidity of the shares, while the market capitalization remains unchanged.

Retained Earnings

The portion of net income not distributed to shareholders as dividends and instead reinvested in the business.

Stable Dividend Policy

A strategy where a company aims to distribute a consistently fixed dividend to shareholders, regardless of the year-to-year fluctuations in earnings.

Q7: What is the amount of miscellaneous liabilities

Q20: What would be the amount of Non-Controlling

Q30: The amount of deferred taxes appearing on

Q38: What is the amount of non-controlling interest

Q43: Which of the following is closest to

Q48: Appendix A of IFRS 3 provides an

Q51: What is the amount of the temporary

Q73: What amount would appear in Yours' Investment

Q75: Assume that the facts provided above with

Q128: Consider the pairs of data presented below