The following information pertains to questions

XYZ Corp has a calendar year end.On January 1,2010,the company borrowed $5,000,000 U.S.dollars from an American Bank.The loan is to be repaid on December 31,2013 and requires interest at 5% to be paid every December 31.The loan and applicable interest are both to be repaid in U.S.dollars.XYZ does not hedge to minimize its foreign exchange risk.

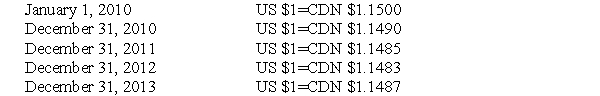

The following exchange rates were in effect throughout the term of the loan:  The average rates in effect for 2010 and 2011 were as follows:

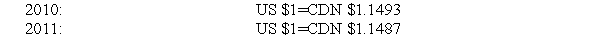

The average rates in effect for 2010 and 2011 were as follows:

-What is the amount of interest expense (in Canadian Dollars) recorded for 2010?

Definitions:

Economic Profits

The difference between the total revenue earned by a firm and the total costs of production, including opportunity costs.

Market Demand Curve

A graphical representation showing the total demand of all consumers in a market for a particular product at different prices.

Colluded

A situation where firms in a market agree to set prices or output levels to maximize collective profits, often at the expense of competition.

Marginal Cost

The financial implication of creating an extra unit of a product or service.

Q2: Assuming that Keen Inc.purchases 100% of Lax

Q13: What is the amount of the forward

Q16: What is the net Income for the

Q21: At what amount would CDN record its

Q22: Which of the following rates would be

Q29: Which of the following rates would be

Q30: Intangible assets with definite useful lives should

Q37: Consolidated Net Income for 2009 would be:<br>A)$69,150<br>B)$57,850<br>C)$58,000<br>D)$56,000

Q51: Which of the following statements pertaining to

Q102: Strawser Company is developing a cost function