The following information pertains to questions

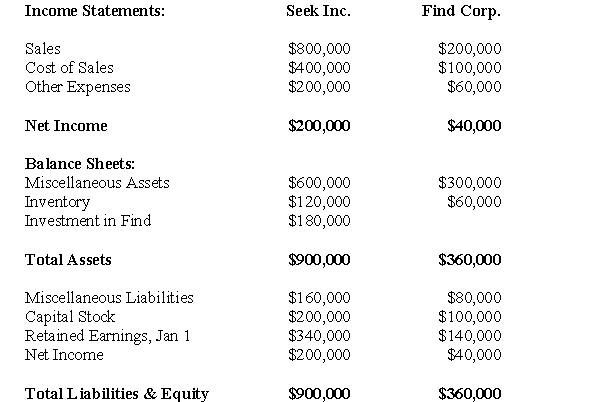

Find Corp.is a joint venture in which Seek Inc.has a 20% interest.Seek uses the equity method to account for its investment but has yet to make any journal entries for 2010.The financial statements of both companies are shown below on December 31,2010.  During 2010,Seek sold merchandise totaling $120,000 to Find and recorded a gross profit of 50% on these sales.At the end of 2010,Find's inventory contained $30,000 worth of merchandise purchased from Seek.Find also owed $50,000 to find at the end of 2010.

During 2010,Seek sold merchandise totaling $120,000 to Find and recorded a gross profit of 50% on these sales.At the end of 2010,Find's inventory contained $30,000 worth of merchandise purchased from Seek.Find also owed $50,000 to find at the end of 2010.

Seek shall use the proportionate consolidation method (current Canadian GAAP) to report its investment in Find Corp.for 2010.Both companies are subject to 40% tax rate.

-What is the amount of unrealized profits in ending inventory?

Definitions:

Absenteeism

The frequent or habitual absence from work or obligations without valid reasons, leading to impacts on productivity and operations.

Implemented Suggestions

Recommendations or ideas that have been put into action within a project, organization, or system to improve efficiency, performance, or outcomes.

Kaplan And Norton

Kaplan and Norton are the creators of the Balanced Scorecard, a strategic management tool that measures organization performance beyond traditional financial metrics.

Balanced Scorecard

A strategic planning and management system that organizations use to communicate what they are trying to accomplish, align the day-to-day work that everyone is doing with strategy, monitor organization performance against strategic goals, and improve various aspects of performance.

Q4: What is the amount of the foreign

Q12: Which of the following statements is FALSE?<br>A)If

Q29: Testing intangible assets with indefinite useful lives

Q30: Intangible assets with definite useful lives should

Q31: Section 4430 of the CICA Handbook contains

Q45: Which of the following statements is correct?<br>A)If

Q46: Ronen Corporation owns 35% of the outstanding

Q49: Heesacker Co. sells a product with a

Q59: What would be the amount of the

Q89: The owner of a local restaurant is