Calculations and analysis should be based on current Canadian GAAP.

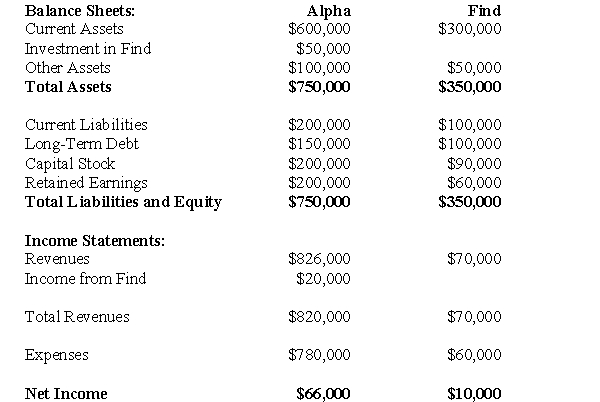

On January 1,2006,Alpha,Beta and Gamma agree to enter into a joint venture and thereby formed Find Corp.Alpha contributed 40% of the assets to the venture,which was also its stake in the venture.Presented below are the financial statements of Alpha and Find as at December 31,2010:  Alpha's Investment has been accounted for using the partial equity method.No intercompany eliminations have been recorded.

Alpha's Investment has been accounted for using the partial equity method.No intercompany eliminations have been recorded.

Alpha supplies Find with an important component that is used by Find as it carries out its business activities.The December 31,2010 inventory of Find contains items purchase from Alpha on which Alpha recorded a gross profit of $10,000.Intercompany sales are always priced to provide the seller with a gross margin of 40% on sales.Both companies are subject to a tax rate of 40%.On December 31,2010,Find still owed $5,000 to Alpha for unpaid invoices.

-Prepare Alpha's Balance Sheet as at December 31,2010.

Definitions:

Synthetic Division

A streamlined method for dividing polynomials, focusing on the coefficients and omits variables and exponents for efficiency.

Polynomial

An algebraic expression consisting of variables and coefficients, combined using only addition, subtraction, multiplication, and non-negative integer exponents.

Numerator

The top part of a fraction that represents how many parts of the whole or group are being considered.

Denominator

The bottom part of a fraction that indicates into how many parts the whole is divided.

Q5: Assuming that DEF456's Plant and Equipment was

Q10: What is the dominant factor used to

Q11: What would be the amount of cash

Q14: What would be the balance in the

Q17: Which of the following is NOT an

Q27: Assuming that the assets were purchased from

Q33: The primary beneficiary of the variable interest

Q42: The amount of non-controlling interest in earnings

Q42: How would any management fees charged by

Q128: Consider the pairs of data presented below