The following information pertains to questions

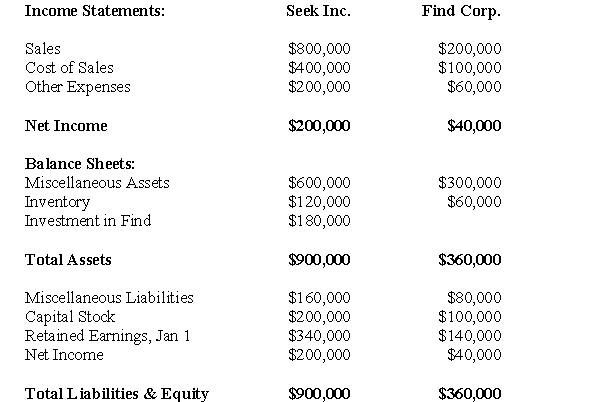

Find Corp.is a joint venture in which Seek Inc.has a 20% interest.Seek uses the equity method to account for its investment but has yet to make any journal entries for 2010.The financial statements of both companies are shown below on December 31,2010.  During 2010,Seek sold merchandise totaling $120,000 to Find and recorded a gross profit of 50% on these sales.At the end of 2010,Find's inventory contained $30,000 worth of merchandise purchased from Seek.Find also owed $50,000 to find at the end of 2010.

During 2010,Seek sold merchandise totaling $120,000 to Find and recorded a gross profit of 50% on these sales.At the end of 2010,Find's inventory contained $30,000 worth of merchandise purchased from Seek.Find also owed $50,000 to find at the end of 2010.

Seek shall use the proportionate consolidation method (current Canadian GAAP) to report its investment in Find Corp.for 2010.Both companies are subject to 40% tax rate.

-What is the total amount of intercompany receivables to be eliminated from the financial statements?

Definitions:

Present Value

The contemporary valuation of an anticipated sum of money or cash flow sequence, based on a given return rate.

Interest Rate

The amount charged, expressed as a percentage of principal, by a lender to a borrower for the use of assets.

Net Present Value

The difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Interest Rate

The proportion of a loan that is charged as interest to the borrower, typically expressed as an annual percentage of the outstanding loan.

Q8: Prepare a partial Balance Sheet for Canada

Q17: Which of the following is NOT an

Q20: Prepare any and all journal entries arising

Q21: What effect would the intercompany bond sale

Q25: Non-Controlling Interest is presented under the Liabilities

Q26: What is the amount of the Liability

Q33: Which of the following influences organizational strategies?<br>A)Organizational

Q70: What is the amount of goodwill arising

Q74: Opportunity costs are:<br>A)Benefits foregone from one project

Q109: Quarterly budget data for Hamburger Haven:<br>Sales $100,000<br>Costs:<br>Ingredients