The following information pertains to questions

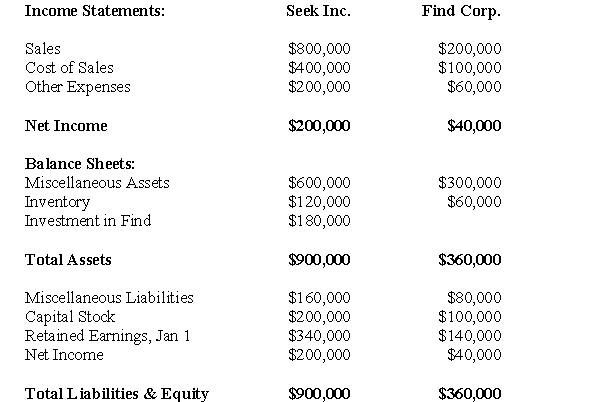

Find Corp.is a joint venture in which Seek Inc.has a 20% interest.Seek uses the equity method to account for its investment but has yet to make any journal entries for 2010.The financial statements of both companies are shown below on December 31,2010.  During 2010,Seek sold merchandise totaling $120,000 to Find and recorded a gross profit of 50% on these sales.At the end of 2010,Find's inventory contained $30,000 worth of merchandise purchased from Seek.Find also owed $50,000 to find at the end of 2010.

During 2010,Seek sold merchandise totaling $120,000 to Find and recorded a gross profit of 50% on these sales.At the end of 2010,Find's inventory contained $30,000 worth of merchandise purchased from Seek.Find also owed $50,000 to find at the end of 2010.

Seek shall use the proportionate consolidation method (current Canadian GAAP) to report its investment in Find Corp.for 2010.Both companies are subject to 40% tax rate.

-What is the total amount of deferred taxes that would appear on Seek's Consolidated Balance Sheet as at December 31,2010?

Definitions:

Growth Factors

Elements or conditions that stimulate development or expansion, particularly in economic or biological contexts.

Chattanooga

A city in southeastern Tennessee, known for its rich history, scenic beauty, and economic significance.

50th Percentile

A statistical measure indicating the value below which 50% of observations in a group fall.

Geometric Mean

The nth root of the product of n numbers, useful for determining the average rate of return over time.

Q32: What is the amount of Consolidated Retained

Q36: Assuming this Business Combination was to be

Q36: In regression analysis, the Adjusted R-square statistic

Q39: Globecorp International has six operating segments,the details

Q40: Under the Cost Method,<br>A)the parent's investment in

Q45: Prepare the December 31,2013 Balance Sheet Presentation

Q50: Prepare YIN's Consolidated Income Statement for the

Q57: The Pooling of Interests Method is no

Q58: What would be the net income reported

Q165: All of the following are true about