Analysis and calculations should be based on the requirements of current Canadian GAAP.

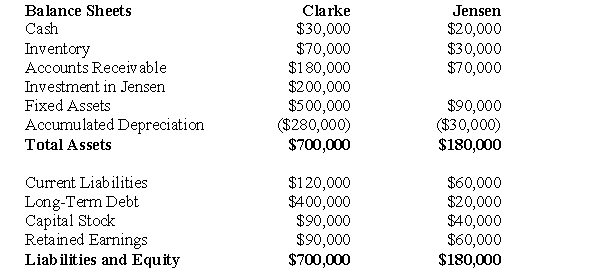

The following balance sheets have been prepared on December 31,2010 for Clarke Corp.and Jensen Inc.  Additional Information:

Additional Information:

Clarke uses the cost method to account for its 50% interest in Jensen,which it acquired on January 1,2007.On that date,Jensen's retained earnings were $20,000.The acquisition differential was fully amortized by the end of 2010.

Clarke sold Land to Jensen during 1999 and recorded a $15,000 gain on the sale.Clarke is still using this Land.Clarke's December 31,2010 inventory contained a profit of $10,000 recorded by Jensen.

Jensen borrowed $20,000 from Clarke during 2010 interest-free.Jensen has not yet repaid any of its debt to Clarke.

Both companies are subject to a tax rate of 20%.

-Prepare a Balance Sheet for Clarke on December 31,2010 in accordance with current Canadian GAAP,assuming that Clarke's investment in Jensen is a control investment.

Definitions:

Absorption Costing

An accounting formula that rolls in every cost incurred in manufacturing—direct materials, direct labor, and both variable and fixed manufacturing overhead—into the product’s final cost.

Markup

The amount added to the cost price of goods to cover overhead and profit, expressed as a percentage of the cost.

Return On Investment

A financial metric used to evaluate the efficiency or profitability of an investment, calculated by dividing the gain from the investment by its cost.

Absorption Costing

An approach to product costing that compounds all expenses involved in manufacturing, such as direct materials, labor costs, and all types of overheads, into the product’s final cost.

Q1: Any excess of fair value over book

Q1: Irrelevant information may be:<br>I. Useful in decision

Q19: What percentage of Marvin's shares was purchased

Q23: The difference between the Investor's cost and

Q30: Assuming that a cost is mixed and

Q34: The cumulative average-time learning curve can be

Q37: Which of the following rates would be

Q39: Which of the following adjustments (if any)to

Q46: Calculate the gain on the contribution of

Q48: Financial statements are:<br>A)External reports produced from an