Analysis and calculations should be made based on current Canadian GAAP.

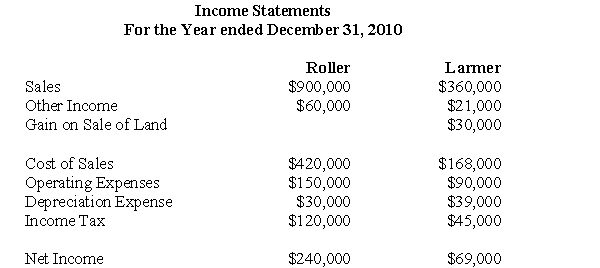

The following are the 2010 Income Statements of Roller Corp and Larmer Corp.  Other Information:

Other Information:

During 2010 Larmer paid dividends of $24,000.Roller acquired its 30% stake in Roller at a cost of $400,000 and uses the cost method to account for its investment.Roller's investment in Larmer shall not be considered a control investment.

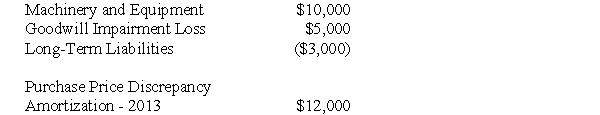

The acquisition differential amortization schedule showed the following write-off for 2010:  During 2010,Larmer paid rent to Roller in the amount of $12,000,which Roller has recorded as other income.

During 2010,Larmer paid rent to Roller in the amount of $12,000,which Roller has recorded as other income.

In 2010,Roller sold Land to Larmer and recorded a profit of $10,000 on the sale.During 2010,Larmer sold the land to a third party.

Both companies are subject to a 40% tax rate.

-Assuming that Larmer is a joint venture that is owned by Roller as well as several other unrelated venturers,prepare Roller's 2013 Income Statement in accordance with current Canadian GAAP.In addition,assume that Roller acquired Larmer after its initial formation,thereby validating the acquisition differentials.

Definitions:

Relatively Rational

decision-making or thinking that is sensible within a specific context, acknowledging that rationality can vary based on circumstances and perspectives.

Little Decision Making

Situations where individuals have minimal or no choice in the decisions affecting them.

Violence Against

The use of physical force or power, threatened or actual, to cause harm, injury, or abuse toward others.

Similar To Murder

Acts or crimes that bear resemblance to murder in their severity or intention, such as manslaughter or attempted murder.

Q14: Relevant information for decisions can focus both

Q25: According to the CICA Handbook and current

Q32: The following are selected transactions from Helpers

Q34: Assuming that Parent Inc acquires 80% of

Q36: How is an Associate's Income from non-operating

Q56: How much Intercompany profit was realized on

Q59: What would be the amount of the

Q72: Frank is considering transportation modes to a

Q88: A firm's production is expected to show

Q148: Which of the following statements is false?<br>A)Information