The following information pertains to questions

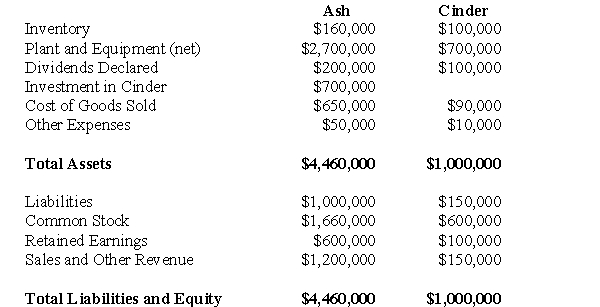

The trial balances of Ash Inc.and its subsidiary Cinder Corp.on December 31,2006 are shown below:  Other Information:

Other Information:

Ash acquired Cinder in three stages:

January 1,2006: Ash purchased 10,000 shares for $100,000.Cinder's Retained Earnings were $40,000 on that date.

January 1,2008: Ash purchased 30,000 shares for $450,000.Cinder's Retained Earnings were $80,000 on that date.

December 31,2009: Ash purchased 20,000 shares for $150,000.Cinder's Retained Earnings were $100,000 on that date.

Cinder was incorporated on January 1,2004.On that date,Cinder issued 100,000 voting shares.Any difference between the cost and book value for each acquisition is attributable entirely to trademarks,which are to be amortized over 5 years.The company has neither issued nor retired shares since the Date of Incorporation.

Ash sold depreciable assets to Cinder at a loss of $20,000 on January 1,2008.These assets had a 10 year remaining life.

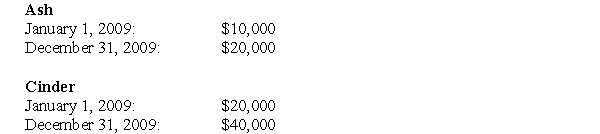

Intercompany Sales of Inventory amounted to $250,000.Unrealized inventory profits for each company are shown below for 2009.The amounts indicate the amount of profit in each company's inventory.  All inventories on hand at the start of 2009 were sold to outsiders during the year.The net Incomes of both companies are evenly earned throughout the year.Both companies are subject to an effective corporate tax rate of 20%.

All inventories on hand at the start of 2009 were sold to outsiders during the year.The net Incomes of both companies are evenly earned throughout the year.Both companies are subject to an effective corporate tax rate of 20%.

-Compute the Consolidated Cost of Goods Sold for 2009.

Definitions:

Preparation Stage

A phase in various processes where planning and arrangements are made before the actual activity or implementation occurs.

Graham Wallas

A social psychologist and co-founder of the London School of Economics, known for his work on creativity and the thought process.

Graham Wallas

A British psychologist and educationalist who contributed to the understanding of creative processes and political psychology.

Verification

The act of confirming the authenticity, correctness, or legitimacy of something.

Q2: This paragraph will discuss traveling on a

Q5: Which of the following statements is correct?<br>A)If

Q10: Which of the following is an alternative

Q15: What would be the amount of the

Q15: Irrelevant cash flows are:<br>A)Avoidable<br>B)Unavoidable<br>C)Objective<br>D)Subjective

Q28: Subject: _ <br>Audience: hikers who don't know

Q33: Which of the following statements is CORRECT?<br>A)A

Q35: What would be the amount of other

Q36: High school and college differ in terms

Q86: The textbook defined open-ended problems as problems