inclusively.Assume that the Entity Method applies (regardless of the dates used in the problems).

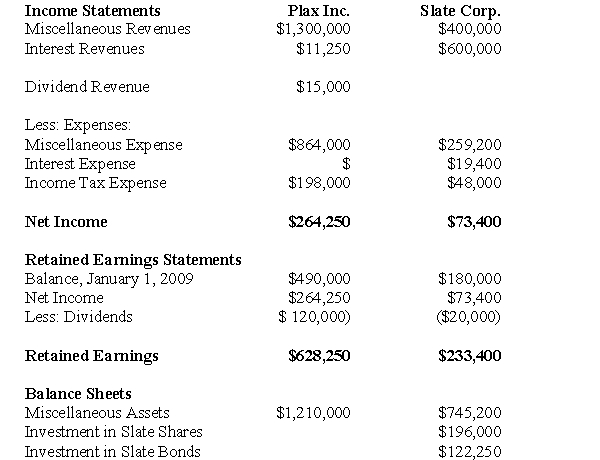

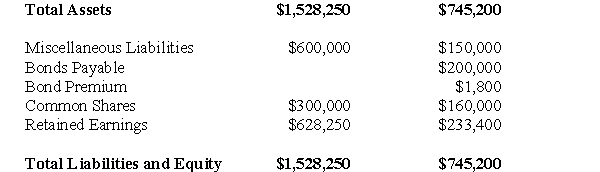

The Financial Statements of Plax Inc.and Slate Corp for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

Plax acquired 75% of Slate on January 1,2005 for $196,000,when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill.There were impairment losses to the goodwill of $6,400 and $1,600 in 2000 and 2003 respectively.

Plax uses the cost method to account for its investment.

Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31,2012.The bonds were issued at a premium.On January 1,2009 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

On January 1,2009,Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

Both companies are subject to a 40% Tax rate.

Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared.

-Prepare a detailed calculation of consolidated retained earnings as at January 1,2009.Do not prepare a Statement of Retained Earnings for this requirement.

Definitions:

Neutrons

Subatomic particles without an electric charge, found in the nucleus of an atom, contributing to the atom's mass.

Electrons

subatomic particles with a negative charge, found in all atoms and acting as the primary carrier of electricity in solids.

Valence Shells

The outermost electron shell of an atom that determines its bonding behavior with other atoms.

Cation

A particle with one or more units of positive charge, such as a hydrogen ion (H+) or calcium ion (Ca2+). Compare with anion.

Q2: On January 1,2004,Black Corporation purchased 15 per

Q14: Relevant information for decisions can focus both

Q17: Which of the following journal entries would

Q30: Which of the following statements is correct?<br>A)If

Q43: According to AcG-15,a company will be required

Q43: You work for a company that manufactures

Q49: Prepare GRL's journal entries for each of

Q56: The Goodwill arising from this Business Combination

Q72: Suppose that you worked for Sonic Inc.and

Q99: Decision quality can best be increased by:<br>A)Thinking