inclusively.Assume that the Entity Method applies (regardless of the dates used in the problems).

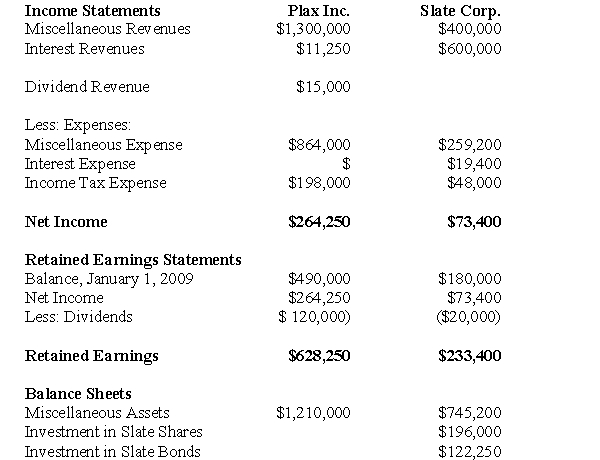

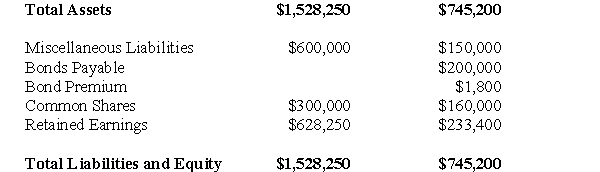

The Financial Statements of Plax Inc.and Slate Corp for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

Plax acquired 75% of Slate on January 1,2005 for $196,000,when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill.There were impairment losses to the goodwill of $6,400 and $1,600 in 2000 and 2003 respectively.

Plax uses the cost method to account for its investment.

Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31,2012.The bonds were issued at a premium.On January 1,2009 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

On January 1,2009,Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

Both companies are subject to a 40% Tax rate.

Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared.

-Prepare a Statement of Non-Controlling Interest for the year ended December 31,2009 for Plax Inc.

Definitions:

Income Tax

A tax levied by governments on individuals' or entities' income, which can vary depending on the amount of income earned.

Regressive Tax

A tax where the tax rate decreases as the taxpayer's income increases, placing a heavier burden on lower-income individuals.

Economy

A system of production, distribution, and consumption of goods and services among individuals and organizations in a society.

Taxable Income

The amount of income that is used to calculate how much tax an individual or a company owes to the government.

Q7: What is ABC's ownership interest in 123

Q16: Does this paragraph compare, contrast, or both?<br>A)

Q18: In which fund would the receipt of

Q21: According to GAAP,what is the key feature

Q24: Assume that the following draft balance sheet

Q25: How would the not-for-profit organization report each

Q28: Which of the following journal entries would

Q33: Which of the following statements is CORRECT?<br>A)A

Q34: For the sake of simplicity,assume once again

Q140: The average cost of producing 200 units